The Only Guide to Fortitude Financial Group

Table of ContentsFortitude Financial Group - An OverviewA Biased View of Fortitude Financial GroupThe Definitive Guide for Fortitude Financial GroupThe 7-Minute Rule for Fortitude Financial Group

With the right plan in position, your money can go even more to assist the companies whose goals are straightened with your values. An economic advisor can help you define your philanthropic providing objectives and integrate them right into your monetary plan. They can likewise recommend you in proper methods to maximize your giving and tax deductions.If your business is a partnership, you will certainly desire to go with the sequence preparation procedure together - Financial Services in St. Petersburg, FL. A financial expert can assist you and your companions understand the vital elements in company sequence preparation, figure out the value of the business, develop shareholder agreements, develop a payment structure for followers, rundown shift options, and a lot more

The key is locating the ideal financial expert for your circumstance; you may finish up engaging various advisors at various stages of your life. Attempt contacting your economic institution for referrals. Content is for educational purposes just and is not intended to supply legal or monetary suggestions. The views and viewpoints expressed do not always stand for the views and point of views of WesBanco.

Our Fortitude Financial Group Statements

Financial advisors help you choose regarding what to do with your money. They guide their clients on saving for major acquisitions, placing cash apart for retired life, and spending cash for the future. They can likewise encourage on present financial and market task. Allow's take a more detailed look at exactly what a financial advisor does.

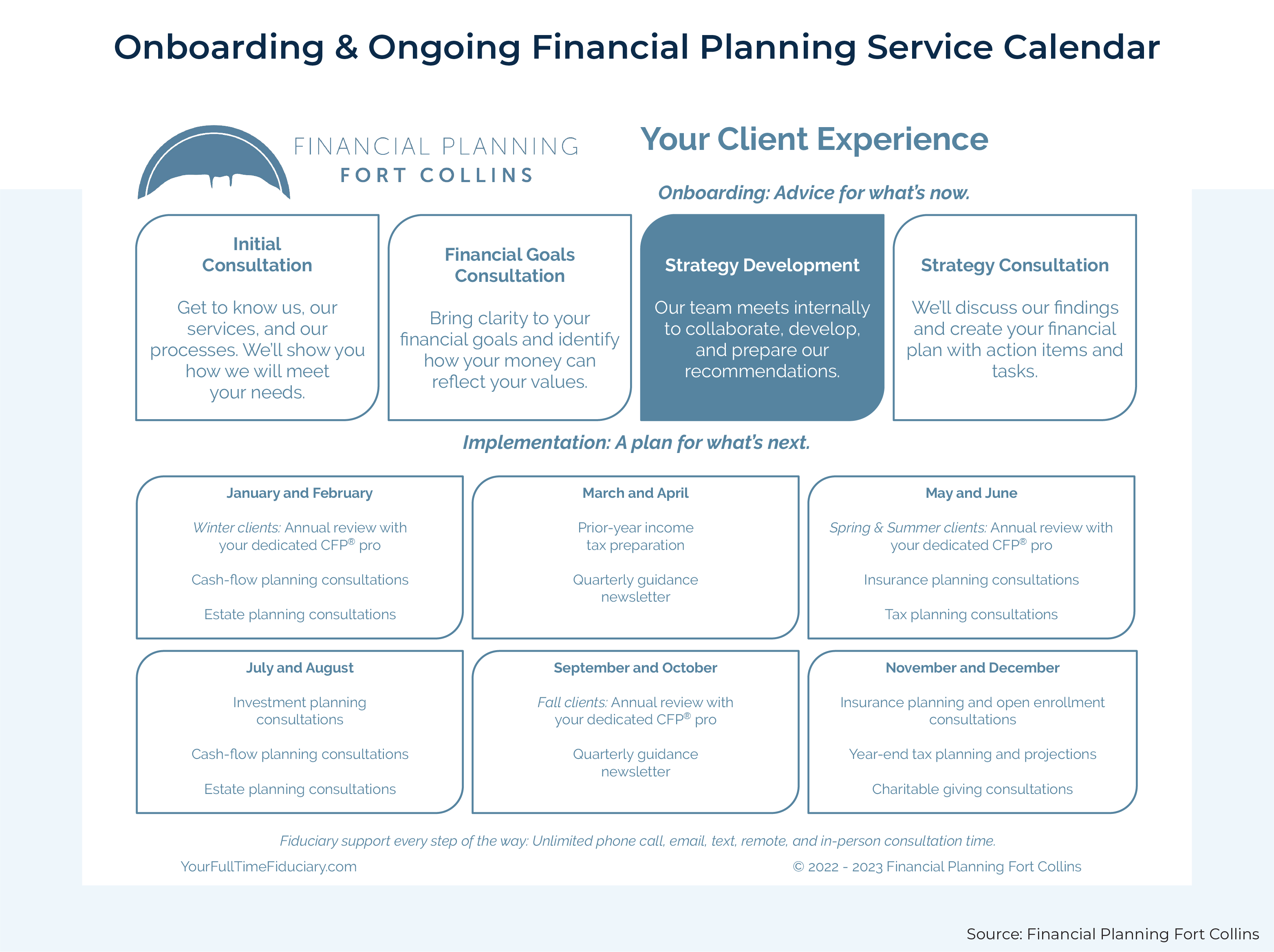

Advisors use their knowledge and proficiency to build individualized monetary plans that aim to accomplish the economic goals of clients (https://sketchfab.com/fortitudefg). These plans include not just investments but additionally savings, budget plan, insurance, and tax obligation strategies. Advisors additionally sign in with their customers often to re-evaluate their existing circumstance and strategy as necessary

Fortitude Financial Group Fundamentals Explained

Let's claim you intend to retire in 20 years or send your child to a personal college in ten years. To accomplish your objectives, you might need a skilled specialist with the appropriate licenses to assist make these plans a reality; this is where a financial advisor can be found in (Financial Services in St. Petersburg, FL). With each other, you and your consultant will certainly cover lots of topics, consisting of the amount of cash you must save, the kinds of accounts you need, the sort of insurance coverage you must have (including long-term treatment, term life, impairment, etc), and estate and tax obligation preparation.

Financial experts supply a selection of services to clients, whether that's supplying reliable basic investment recommendations or aiding within a financial goal like spending in an university education and learning fund. Listed below, locate a list of the most common services offered by monetary advisors.: An economic expert offers guidance on financial investments that fit your design, objectives, and threat resistance, creating and adapting investing method as needed.: An economic expert develops approaches to aid you pay your debt and avoid debt in the future.: An economic consultant gives suggestions and techniques to develop budget plans that assist you satisfy your goals in the brief and the lengthy term.: Component of a budgeting technique may consist of strategies that aid you spend for higher education.: Likewise, a financial expert develops a conserving plan crafted to your particular needs as you head right into retirement. http://prsync.com/fortitude-financial-ffg/.: A monetary expert helps you determine individuals or organizations you intend to get your heritage after you pass away and creates a strategy to lug out your wishes.: A financial consultant gives you with the very best long-lasting remedies and insurance policy options that fit your budget.: When it pertains to tax obligations, a financial consultant might help you prepare income tax return, optimize tax obligation reductions so you obtain one of the most out of the system, routine tax-loss gathering protection sales, guarantee the very best use of the funding gains tax rates, or plan to minimize taxes in retirement

On the questionnaire, you will certainly additionally indicate future pensions and income sources, job retirement requires, and define any kind of long-term economic commitments. In other words, you'll note all current and expected financial investments, pension plans, gifts, and incomes. The spending element of the survey touches upon more subjective subjects, such as your danger tolerance and risk capacity.

Not known Incorrect Statements About Fortitude Financial Group

At this factor, you'll additionally let your consultant understand your financial investment choices. The initial assessment may likewise consist of an evaluation of various other monetary monitoring topics, such as insurance policy issues and your tax obligation situation.

Comments on “The Fortitude Financial Group Ideas”